Why People Are Suddenly Saving More in 2025 Around the World — and How You Can Too

The age of revenge spending is slowing down. Across the world, people are going back to basics: saving, budgeting, and simplifying. Here’s why — and how you can start too. From the U.S. to Europe and even India, more people are cutting back on spending and saving again.

Remember the post-pandemic spending spree? That “you only live once” attitude that led people to travel more, eat out, and shop without blinking?

Well, 2025 has flipped the script. From the U.S. to Europe and even India, more people are cutting back on spending and saving again.

Let’s explore why that’s happening — and how you can ride this wave to build your own financial buffer.

💡 What’s Causing the Shift?

- Economic anxiety — People fear layoffs, inflation, or interest rate hikes

- Savings regret — Overspending during 2022–2023 has left many feeling vulnerable

- Higher living costs — Rent, groceries, fuel — everything is up

- Financial maturity — A growing trend toward minimalism and budgeting tools

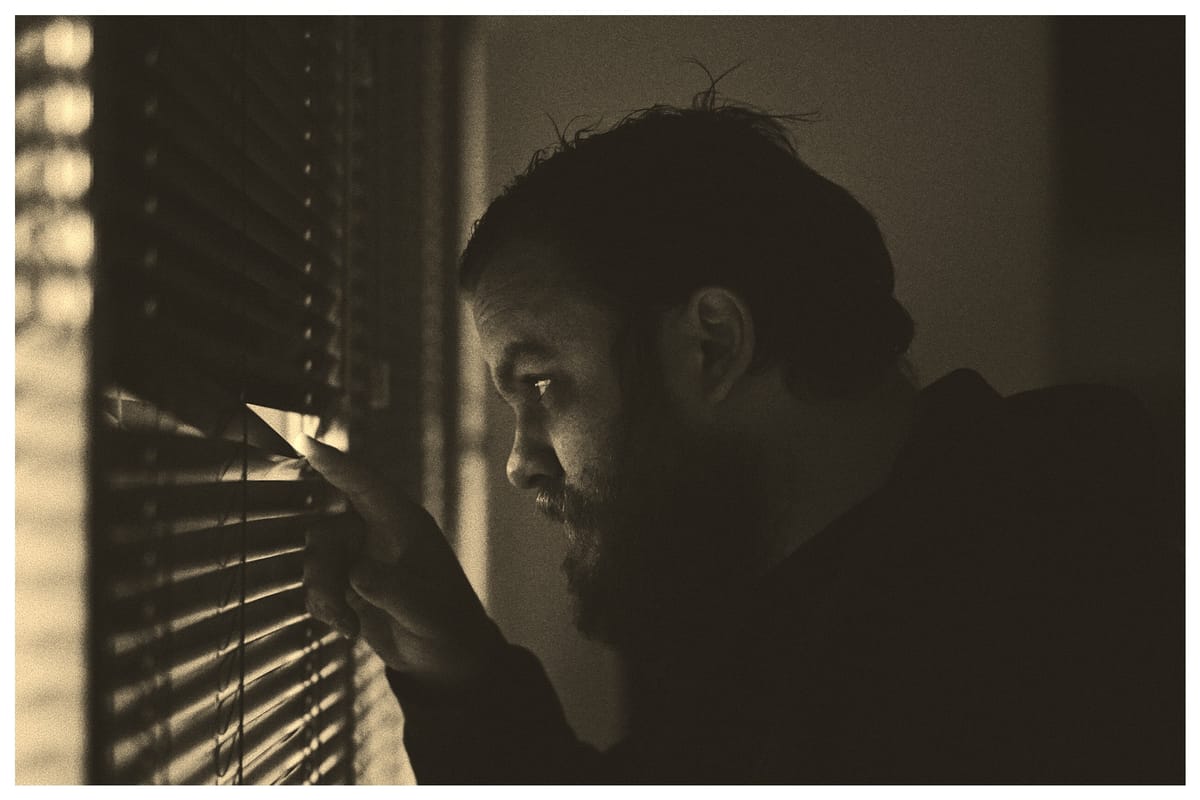

🔄 The “Revenge Saving” Trend

Yes, it’s the opposite of revenge spending.

People are:

- Skipping online impulse buys

- Setting auto-debits to savings

- Tracking expenses again

- Choosing cheaper alternatives (public transport, homemade meals, fewer subscriptions)

💰 How You Can Save Smarter Too

| Habit | What to Do |

|---|---|

| 🟢 Auto-save weekly | Use your bank or UPI app to save $5/₹500/week |

| 🔴 Cancel 1 thing | Drop one streaming or subscription you ignore |

| 🟡 Spend-free days | Pick 2–3 “no spend” days a week |

| 🟢 Build a micro fund | Start with a 30-day “₹100/day” saving plan |

🌎 This is a Global Movement

- 🇺🇸 U.S. savings rates climbed 4.9% in April 2025

- 🇬🇧 UK households are buying fewer “wants” to prioritize mortgages

- 🇮🇳 Indians are shifting from shopping apps to SIPs again

📌 Final Thoughts

You don’t have to save big. Just start small. Like millions worldwide, the shift back to basics might just be your best financial move in 2025.

⚠️ Disclaimer:

This post is for educational purposes only. Always consult a financial advisor for decisions based on your unique situation.

Let's read next – inspire you 🚀