The ‘Buy Nothing’ Challenge: Could You Go 30 Days Without Spending on Wants?

What started as a small movement has now gone global — people in the U.S., Europe, and Asia are trying to spend ₹0 or $0 on non-essentials for a full month. Could you do it? Here's how the Buy Nothing Challenge works — and why it might change your financial mindset forever.

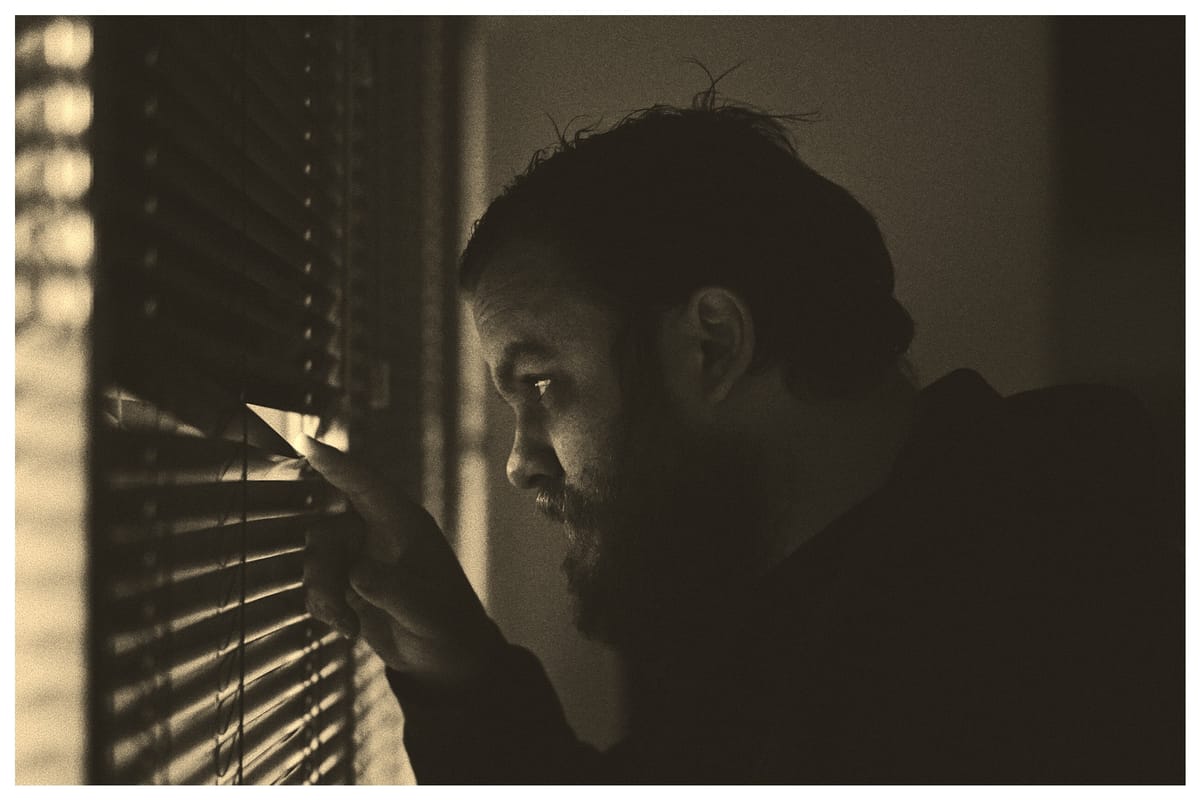

Imagine not spending a single rupee or dollar on “extra” stuff for 30 days.

No new clothes.

No random Amazon carts.

No takeaway coffee or Friday pizzas.

That’s the idea behind the Buy Nothing Challenge — a growing movement helping people reset their spending habits and discover the joy of mindful money.

🧩 What Is the Buy Nothing Challenge?

It’s simple:

You commit to not buying anything non-essential for a set period — usually 7, 15, or 30 days.

🟢 You can spend on:

- Rent, utilities, groceries, medicine, transport

🔴 You avoid spending on:

- Shopping apps

- Food delivery

- New gadgets

- Home decor

- Impulse purchases

🌐 Where It Started (And Where It’s Going)

- Originated in small U.S. Facebook groups around 2013

- In 2025, the official Buy Nothing App has over 1.6 million downloads

- Spreading fast in Canada, UK, Australia — and now entering Indian metros too

- Instagram hashtags like

#BuyNothingChallengeare trending among Gen Z

The challenge is no longer about “being cheap.” It’s about regaining control.

🔄 What You Learn by Buying Nothing

- 🎯 Needs vs Wants: You realize how many purchases are emotional

- 🧘 Mental clarity: Less shopping = less clutter = less stress

- 💰 Automatic saving: You stop leaks without even budgeting

- 🤝 Community exchange: In many cities, people swap items instead of buying

✅ How to Try It (Even if You're New)

| Step | Tip |

|---|---|

| Pick a start date | Choose a Monday or 1st of the month |

| Set a period | 7, 15, or 30 days — your call |

| Make rules | Essentials only — write them down |

| Track urges | Keep a “things I didn’t buy” list |

| Celebrate wins | Every day you skip a purchase = win |

💡 Bonus: Add a visual savings tracker — see how much you saved in 30 days.

📢 Global Stories, Local Impact

From New York to New Delhi, people are trying this challenge and reporting:

- Better sleep

- Less anxiety

- Stronger financial discipline

Even skipping 3 impulse buys a week can help you save ₹1,500–₹2,000 or $30–$50 per month.

💬 Quote You Can Use:

“When I stopped buying what I didn’t need, I discovered what actually mattered.”

⚠️ Disclaimer:

This blog is for educational and motivational purposes only. Your spending choices are personal. Always consult professionals for personalized advice.

Let's read next – inspire you 🚀